Allianz Care Australia

Allianz Care Australia

CBHS International Health

CBHS International Health

If you’re using Hospital Cover to pay for surgery or a hospital procedure as a private patient, you probably assume your insurer will pick up the bill. But unfortunately health insurance doesn’t always cover 100% of the private hospital costs – sometimes there will be out-of-pocket costs, also known as Gaps.

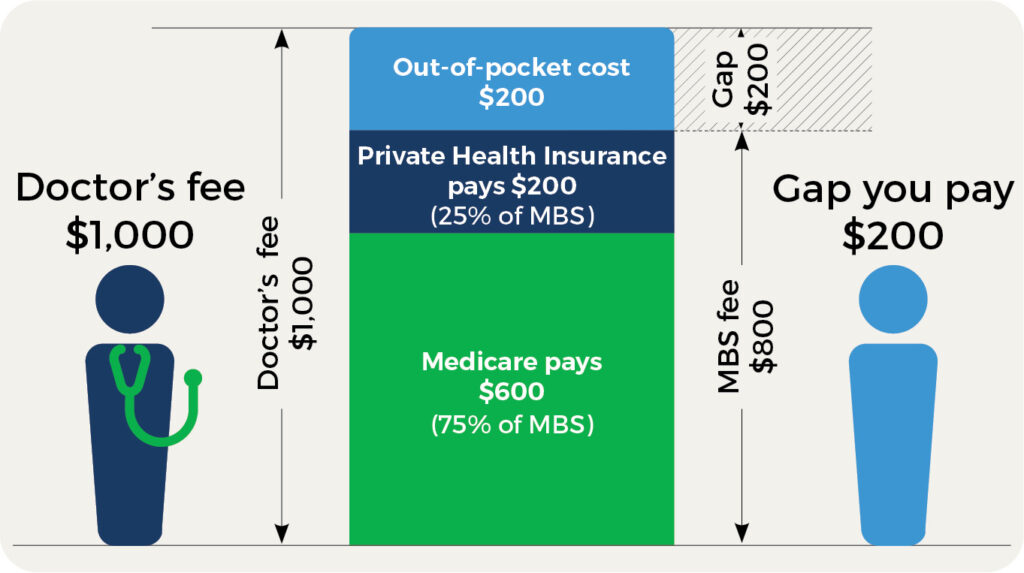

So what is a Gap? A Gap is the out-of-pocket cost you are responsible for paying. The price of a hospital procedure is known as the Medicare Benefit Schedule Fee (MBS Fee), and it will be covered by Medicare and your private health insurer combined. However sometimes specialist fees are higher than the MBS Fee, which leaves a Gap for you to pay – this is known as a Medical Gap.

There are 2 types of Gaps you might face for a Hospital Cover claim, which apply whether you’re in a private hospital or you’re a private patient in a public hospital:

- Medical Gap – for doctor and specialist fees. When specialist fees are higher than the MBS Fee, you will have a Medical Gap to pay

- Hospital Gap – for hospital fees, including theatre costs and accommodation. When a private hospital charges more than what your health insurer will pay, the difference is a Hospital Gap that you will have to pay.

If you’re facing a hospital procedure as a private patient and want to reduce your out-of-pocket costs, here are our top 4 tips.

How to lower out-of-pocket costs for private hospital treatment

1. Get a cost breakdown

When your doctor or specialist recommends you for hospital treatment, ask for a full breakdown of fees. Make sure it includes the MBS item number and fees for all doctors involved including anaesthetists, and hospital costs such as accommodation. Then, compare that against average fees and Gaps for that procedure, using the government’s Medical Cost Finder website. This will tell you whether the Gap is in the normal range.

2. Look for a different provider

If you have to pay a Medical Gap, the first step is to look for a different provider who charges a lower (or no) Gap. Phone other specialists’ practices and quote your MBS item number – they can tell you how much the specialist charges for that service. It’s also a good idea to contact your insurer and ask whether they have ‘no Gap’ or ‘known Gap’ arrangements with relevant specialists. Some insurers provide an online search option for healthcare providers, like this one from HCF.

Tip:

Even if specialists have an agreement with your insurer, they aren’t obligated to honour it. Ask your specialist to confirm in writing whether they will honour their ‘no Gap’ or ‘known Gap’ agreement with your insurer.

3. Change hospitals

If you’re being treated in a private hospital you could face a Hospital Gap for costs such as accommodation and theatre fees.

Many insurers have arrangements with certain hospitals, known as Agreement Hospitals. This means members can get treatments with either no Hospital Gap or a ‘known’ Hospital Gap (at a capped amount). If your specialist has recommended treatment at a hospital which doesn’t have an agreement with your insurer, ask them whether your procedure can be done in one of your insurer’s Agreement Hospitals. You can ask your insurer for a list of their Agreement Hospitals, or search here.

By the way, there usually isn’t a Hospital Gap if you’re being treated as a private patient in a public hospital.

4. Change policies

If you’re disappointed by the cover on your policy, changing policies could help you lower out-of-pocket costs – but only if you change to a policy at the same level with the same excess (if you change to a higher tier you’ll have to serve a waiting period before you can claim). Finding health insurance might sound time-consuming, but at healthslips.com.au we’ve taken the hard work out, creating a handy Calculator that lets you search every policy from every insurer in Australia in a matter of seconds. We give you all your policy options with no bias, and you don’t have to sign up or give any contact details to get your results. It’s fast and it’s free – try looking for a new policy or compare your current policy with others today.

Knowledge is power – that’s the guiding principle behind everything Trudie writes, and it’s a philosophy she brings to her work at healthslips.com.au. By breaking down complex information into easy-to-understand blogs and stories, she aims to empower Australians to make the best choices and an informed decision around private health insurance.

Trudie understands firsthand some of the complexity of private health insurance having moved to Australia from New Zealand and having to navigate a vastly different public healthcare system and health insurance structure.

Trudie holds a Bachelor of Communication Studies (journalism major) from the Auckland University of Technology.