Explore Overview

Guides Overview

Australian Health System

(25 articles)

Health Insurance Prices

(20 articles)

Private Health Insurance

(34 articles)

Private Health Insurers

(15 articles)

Medicare

(28 articles)

Medicare Benefits Schedule (MBS)

(6 articles)

Pharmaceutical Benefits Scheme (PBS)

(8 articles)

Public Hospitals

(6 articles)

Private Hospitals

(7 articles)

Medicare Levy

(7 articles)

Private Health Insurance Rebate

(7 articles)

Age-based Discount

(5 articles)

Lifetime Health Cover Loading

(11 articles)

Insurers Overview

AAMI Health Insurance

AAMI Health Insurance

ACA Health

ACA Health

ahm

ahm

AIA Health Insurance

AIA Health Insurance

Allianz Care Australia

Allianz Care Australia

APIA Health Insurance

APIA Health Insurance

Astute Simplicity Health

Astute Simplicity Health

Australian Unity

Australian Unity

Bupa Health Insurance

Bupa Health Insurance

CBHS Corporate

CBHS Corporate

CBHS Health

CBHS Health

CBHS International Health

CBHS International Health

Defence Health

Defence Health

Doctors’ Health

Doctors’ Health

Emergency Services Health

Emergency Services Health

Frank

Frank

GMHBA

GMHBA

GU Health

GU Health

HBF

HBF

HCF

HCF

HCi

HCi

Health Partners

Health Partners

HIF

HIF

Hunter Health Insurance (by CDH Benefits Fund)

Hunter Health Insurance (by CDH Benefits Fund)

ING Health Insurance

ING Health Insurance

Latrobe Health Services

Latrobe Health Services

Medibank

Medibank

Mildura Health Fund

Mildura Health Fund

Navy Health

Navy Health

nib

nib

Nurses & Midwives Health

Nurses & Midwives Health

onemedifund

onemedifund

Peoplecare

Peoplecare

Phoenix Health Fund

Phoenix Health Fund

Police Health

Police Health

Priceline Health Insurance

Priceline Health Insurance

Qantas Insurance

Qantas Insurance

Queensland Country Health Fund

Queensland Country Health Fund

Real Health Insurance

Real Health Insurance

Reserve Bank Health Society (RBHS)

Reserve Bank Health Society (RBHS)

RT Health

RT Health

see-u by HBF

see-u by HBF

Seniors Health Insurance

Seniors Health Insurance

St Lukes Health

St Lukes Health

Suncorp Health Insurance

Suncorp Health Insurance

Teachers Health

Teachers Health

Territory Health Fund

Territory Health Fund

Transport Health

Transport Health

TUH

TUH

UniHealth

UniHealth

Union Health

Union Health

Westfund

Westfund

Allianz Care Australia

Allianz Care Australia

CBHS International Health

CBHS International Health

News Overview

Health insurance premiums rise to 9-year high

Higher Gaps forcing many people to delay care, survey finds

Health insurance giving Aussies less value, doctors say

Insurers paying more for hospital claims, new data shows

Aussies paying steep Gaps for specialist care, data shows

Govt warns insurers about premium increases

ACT residents paying high Gaps, as premiums set to rise

Hospital Cover claims jump 11.6% amid public hospital strain

Compare Overview

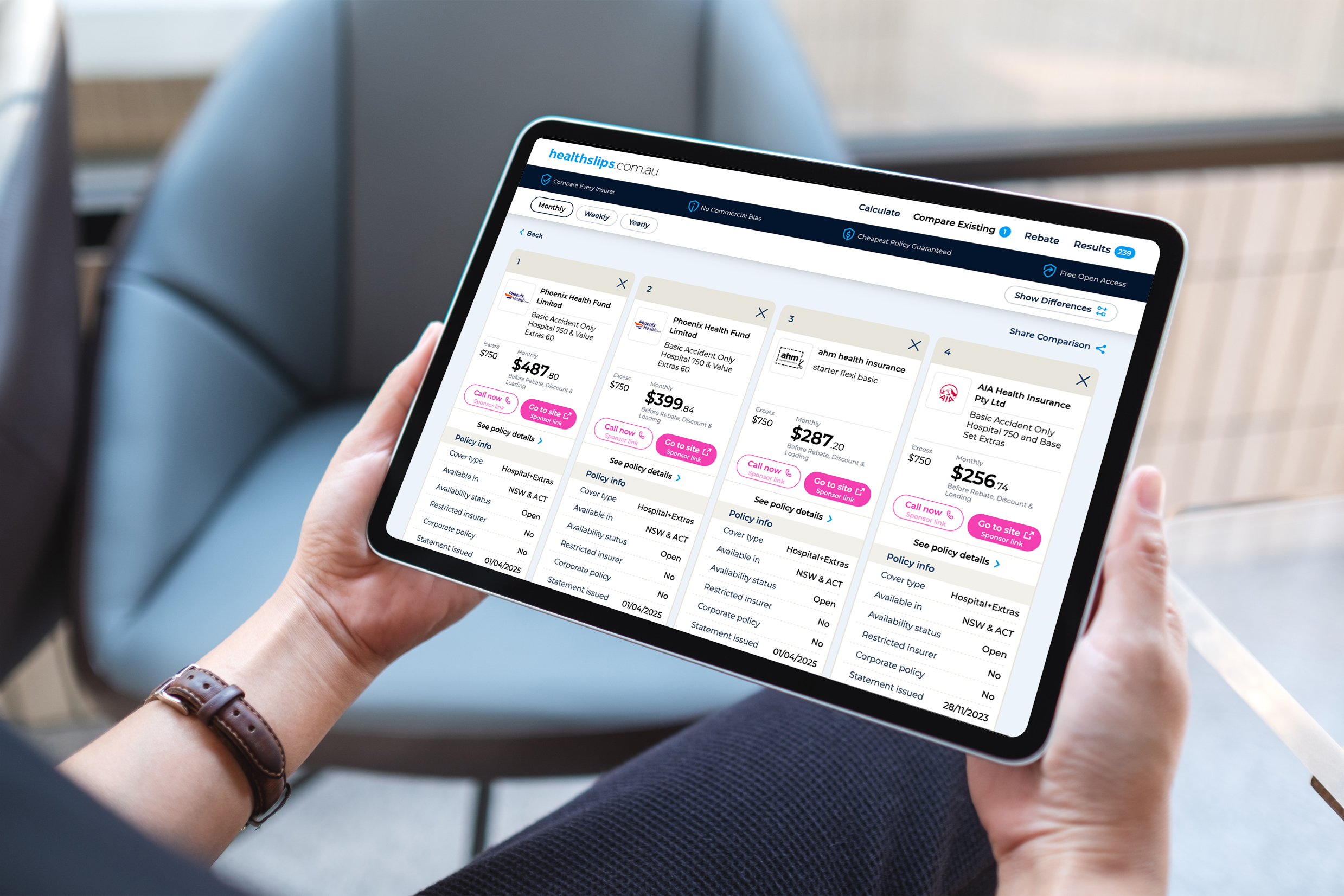

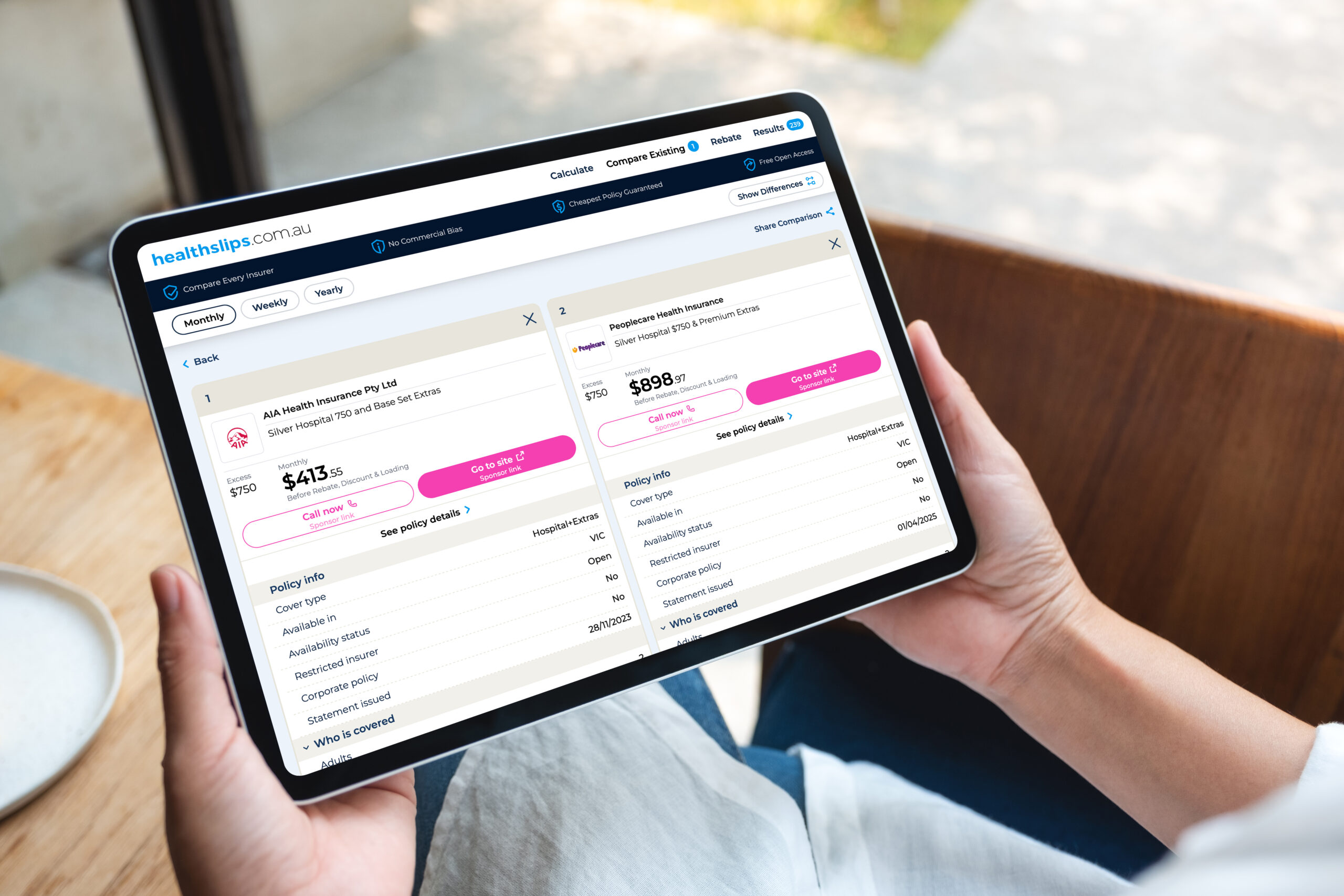

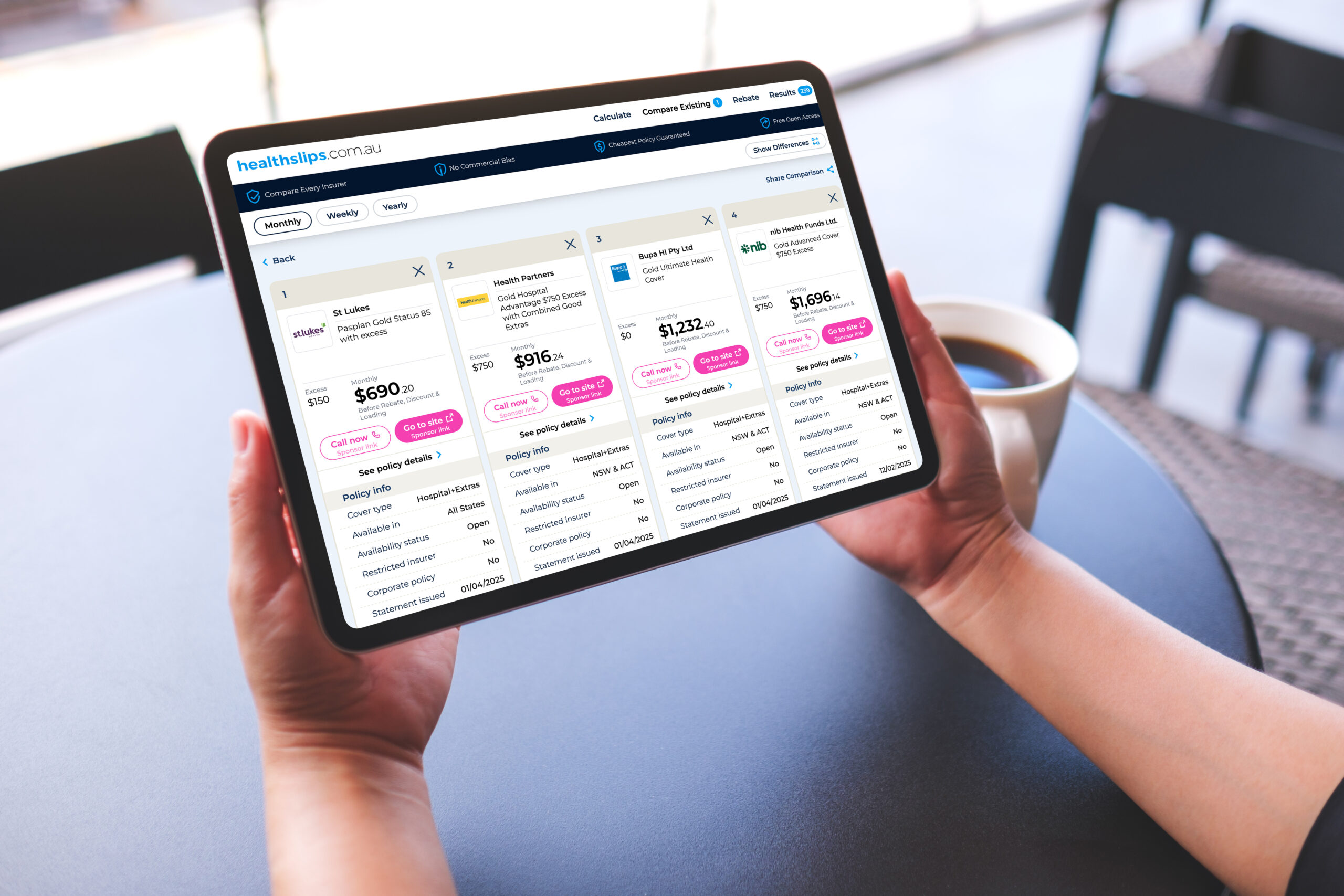

Calculate Cheapest Policy

Search for a new policy based on your health cover needs and budget. We compare every insurer and every policy.

Policies change monthly, stay informed

Subscribe to stay informed. Insurers regularly update policies, introduce new policies and close policies. Our data is updated monthly.